LTC Price Prediction: Technical Pressure vs. Evolving Crypto Landscape

#LTC

- LTC trades below key technical levels with bearish MACD momentum

- Broader crypto adoption trends provide positive backdrop but lack LTC-specific catalysts

- Critical support at $107 with resistance at the 20-day moving average of $114

LTC Price Prediction

LTC Technical Analysis: Bearish Signals Dominate Short-Term Outlook

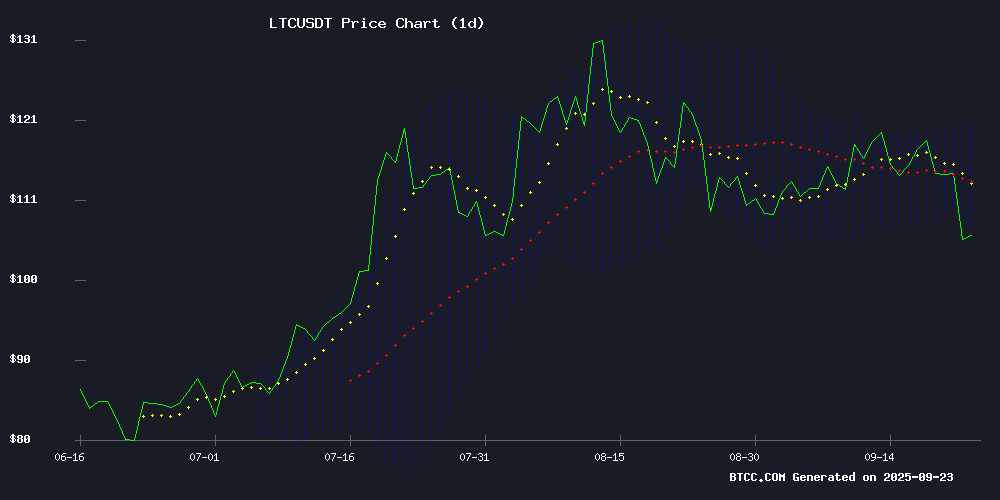

LTC currently trades at $107.09, below its 20-day moving average of $113.96, indicating bearish momentum. The MACD reading of -1.0058 versus -1.3558 shows continued negative momentum, though the positive histogram of 0.3500 suggests potential slowing of downward pressure. Price sits NEAR the lower Bollinger Band at $107.19, which may act as support. According to BTCC financial analyst Ava, 'LTC faces technical headwinds with key resistance at the 20-day MA. A break above $114 could signal trend reversal, while failure to hold $107 support may lead to further declines.'

Market Sentiment Mixed Despite Positive Crypto Developments

Recent news highlights growing institutional adoption with Dogecoin ETF approvals and legislative pressure to open 401(k) markets to crypto. However, LTC-specific catalysts remain limited. BTCC financial analyst Ava notes, 'While broader crypto sentiment improves with ETF approvals and institutional interest, LTC lacks direct positive catalysts. The whale accumulation in BTC and SOL suggests capital rotation away from altcoins like LTC in the short term.'

Factors Influencing LTC's Price

Dogecoin ETF Approval Signals Mainstream Adoption as Meme Coin Joins Bitcoin and Ethereum

Dogecoin has transcended its origins as an internet joke to become a regulated financial instrument, with the recent approval of a DOGE-based ETF in the United States. The listing marks a watershed moment for cryptocurrencies, demonstrating their evolution from fringe assets to components of traditional investment portfolios.

The meme coin's journey from Litecoin-derived novelty to exchange-listed asset reflects broader crypto market maturation. Built on Scrypt algorithm technology, Dogecoin gained early adoption through microtransactions and social media tipping—its low fees and fast transactions creating organic utility that now underpins institutional acceptance.

While volatility remains a challenge for retail traders, the ETF debut provides exposure to investors seeking regulated crypto assets. Market observers note the development completes Dogecoin's improbable trajectory, placing it alongside Bitcoin and ethereum as recognized store-of-value instruments.

U.S. Lawmakers Push SEC to Open $12.5T 401(k) Market to Crypto

House Financial Services Committee leaders are urging the SEC to accelerate rule changes that would allow cryptocurrency investments in retirement plans. The move follows President Trump's executive order directing regulators to expand 401(k) access to alternative assets.

The September 22 letter from Chairman French Hill and Ranking Member Maxine Waters presses SEC Chair Paul Atkins to align regulations with the August 7 directive. The policy could potentially channel portions of the massive retirement market into digital assets.

The executive order specifically tasks multiple agencies with removing barriers to 401(k) investments in private equity, real estate, and cryptocurrencies. Over 90 million American retirement account holders stand to gain new investment options if implemented.

Whale Bets $15 Million on BTC, SOL, HYPE, and PUMP Amid Market Downturn

A crypto whale has placed a $15 million leveraged long bet on Bitcoin (BTC), Solana (SOL), Hyperliquid (HYPE), and Pump.fun (PUMP) as the broader market experiences a sharp decline. The move signals bullish conviction despite Bitcoin dropping below $115,000 and altcoins facing heavy selling pressure.

Lookonchain data reveals the whale deposited 15 million USDC into Hyperliquid's derivatives platform to open the positions. This counter-trend play highlights institutional-grade confidence in these assets' rebound potential during a period where the crypto fear and greed index has plunged to extreme fear levels.

The market-wide liquidation event saw major altcoins like Ethereum (ETH), XRP, and Litecoin (LTC) mirror Bitcoin's downward trajectory. Yet the whale's concentrated bet on select tokens suggests a strategic differentiation between temporary pullbacks and fundamentally sound projects.

Quid Miner's Sustainable Cloud Mining App Offers Passive Income for BTC, ETH, and XRP Holders

The approval of Bitcoin and Ethereum ETFs, coupled with the anticipated launch of an XRP ETF, has reignited interest in the cryptocurrency market. While these financial instruments provide institutional investors with compliant exposure to crypto prices, they fall short of addressing the demand for stable cash flow in a volatile market.

UK-based Quid Miner, operational since 2010 and active in cloud mining since 2018, is capitalizing on this gap. The platform combines regulatory compliance with green energy initiatives and automated optimization to deliver predictable passive income streams. Its AI-driven system dynamically allocates computing power to high-potential assets including BTC, ETH, and XRP.

With data centers powered by renewable energy sources, Quid Miner meets ESG criteria favored by institutional investors. The platform supports multiple cryptocurrencies and employs enterprise-grade security solutions to protect user assets.

Is LTC a good investment?

Based on current technical and fundamental analysis, LTC presents a cautious short-term outlook. The cryptocurrency trades below key moving averages with bearish MACD signals, though Bollinger Band positioning suggests potential support. Fundamentally, while the broader crypto market benefits from institutional adoption trends, LTC lacks specific catalysts compared to major assets like BTC and ETH.

| Metric | Current Value | Signal |

|---|---|---|

| Price | $107.09 | Below MA |

| 20-Day MA | $113.96 | Resistance |

| MACD | -1.0058 | Bearish |

| Bollinger Lower | $107.19 | Support |

BTCC financial analyst Ava suggests monitoring the $107 support level closely. 'Investors should wait for confirmation of trend reversal above $114 before considering new positions. The 401(k) market developments could provide secondary support if implemented.'